Author: Ashley Charest

Financial Literacy

Published:

Wednesday, 29 Sep 2021

Sharing

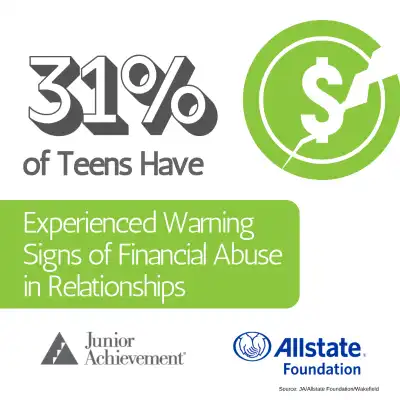

Image caption: Finances in Relationships

According to a new study by Junior Achievement (JA) and The Allstate Foundation, nearly 1 in 3 U.S. teenagers aged 13-18 (31%) have experienced unhealthy financial warning signs in a romantic relationship. Both teen girls and boys reported being prevented from going to school or work or being told what they could or could not purchase.

Well over half of teens (61%) trust their parents or guardians the most to teach them about healthy shared finances with a romantic partner or friend. However, a majority of teens (55%) have heard their parents argue about money within the last 30 days, and a third (33%) agree that their parents spend money on things they don't need instead of supporting the family. Despite this, a significant percentage of teens (30%) have spoken with their parents or guardians on how to share expenses with a friend or romantic partner.

"These statistics are concerning because they may be early indicators of what could become lifelong behaviors affecting these teens," said Ashley Charest, President, Junior Achievement of Kansas. "At Junior Achievement, we promote financial literacy to young people to increase their financial capability as adults. We believe financial literacy can be one tool in helping today's teens recognize and address unhealthy financial relationships with the hope of preventing future financial abuse."

To help high school students recognize and avoid unhealthy financial relationships, Junior Achievement and The Allstate Foundation have partnered to redevelop JA Personal Finance 2.0, a financial literacy program for teens. The redevelopment includes new discussion topics and activities focused on aspects of both healthy and unhealthy financial relationships.

"Financial abuse is a form of domestic violence and one of the main reasons victims can't leave their abusive partners," said Francie Schnipke Richards, vice president of social responsibility at The Allstate Foundation, "We know that relationship violence can start at a young age, and the results from this study underscore the importance of teaching young people about healthy financial relationships early. We're proud to work with Junior Achievement USA to better equip young people with this education to help prevent violence before it starts."

More findings from the survey include:

- 37% of teens have felt pressure to say "yes" when a romantic partner has asked them for money. The number increases among Asian (40%), Black (45%), and Hispanic (44%) teens. Boys (41%) are also more likely to agree than girls (34%).

- 29% reported a partner did not pay them back as expected, and 22% were told who they could and could not hang out with

- 62% of teens (66% of girls vs. 59% of boys) agree that they are not ready to manage shared financial responsibilities with a friend or romantic partner.

Survey Methodology:

The Junior Achievement/Allstate Foundation Teen Healthy Financial Relationships Survey 2021 was conducted by Wakefield Research (www.wakefieldresearch.com) among 1,000 nationally representative U.S. teens ages 13-18, with an oversample of 100 Asian Americans, between July 16 and 22, 2021, using an email invitation and an online survey.

Get Involved with Junior Achievement!

Select a button below to see how you or your organization can get involved with Junior Achievement of Kansas, Inc..